Beaufort City Council met for a Special Work Session on Tuesday, November 19. Two topics were on the agenda: Tourism Development Advisory Committee State Accommodations Tax Grant (ATAX) Award Recommendations, and City Owned Properties – Return on Investment (ROI) Analysis.

Accommodations Tax (ATAX) Allocations

$969,333 of ATAX money (p.4-5) took up the first half of the meeting. Applications were submitted to the city from different organizations and festivals to help with events, marketing, and operations. Money went to support and fund Port Royal Sound Foundation, the 2025 Gullah Festival, Beaufort International Film Festival 2025, and the Beaufort Area Hospitality Association to name a few. In addition to the applications for funding, the city also proposed setting aside some of the money for the city’s General Fund, Police Department support, and other internal funding.

Highlights from the conversation include that Councilman Josh Scallate spoke for almost 20 minutes straight, taking up more than half of the ATAX portion of the meeting. Councilman Scallate went line by line and gave his thoughts on each of the applications for ATAX funding. There were two items of note that he stirred up with his comments.

First, Scallate brought up $100,000 (p.5) that was slated to go to “Downtown Twilight Hours”. Scallate asked city officials if this was the same $100,000 that had already been approved or an additional $100,000 going to that initiative aimed at getting more commerce downtown in the evening hours. Scallate requested data to show whether or not the first $100,000 had shown any results before allocating another $100,000. For almost five full minutes, City Manager Scott Marshall, City Finance Director Alan Eisenman, and Councilman Scallate went back and forth trying to figure out if this was a new $100,000 or a carryover from last year. In the end, Scott Marshall stated that it was the same money from last year, but no one seemed confident in that answer.

The second topic Scallate brought up that spurred discussion was about the Annual Gullah Festival. Scallate questioned why the Gullah Festival had requested more money than last year, particularly in the area of marketing. Two representatives from the Gullah Festival who were present in the audience took exception to Scallate’s comments and let the council know during public comments. (Due to poor sound quality on the recording of the meeting, the names of the Gullah Festival representatives are not included.) One of the commenters emphasized that the Gullah Festival puts “heads in beds” from all over the United States and the revenue brought to the city by the festival more than makes up for the amount for which they were asking. The recommendation was that the Gullah Festival receive $21,500, a little less than half what they requested.

City Owned Properties – Return on Investment (ROI) Analysis

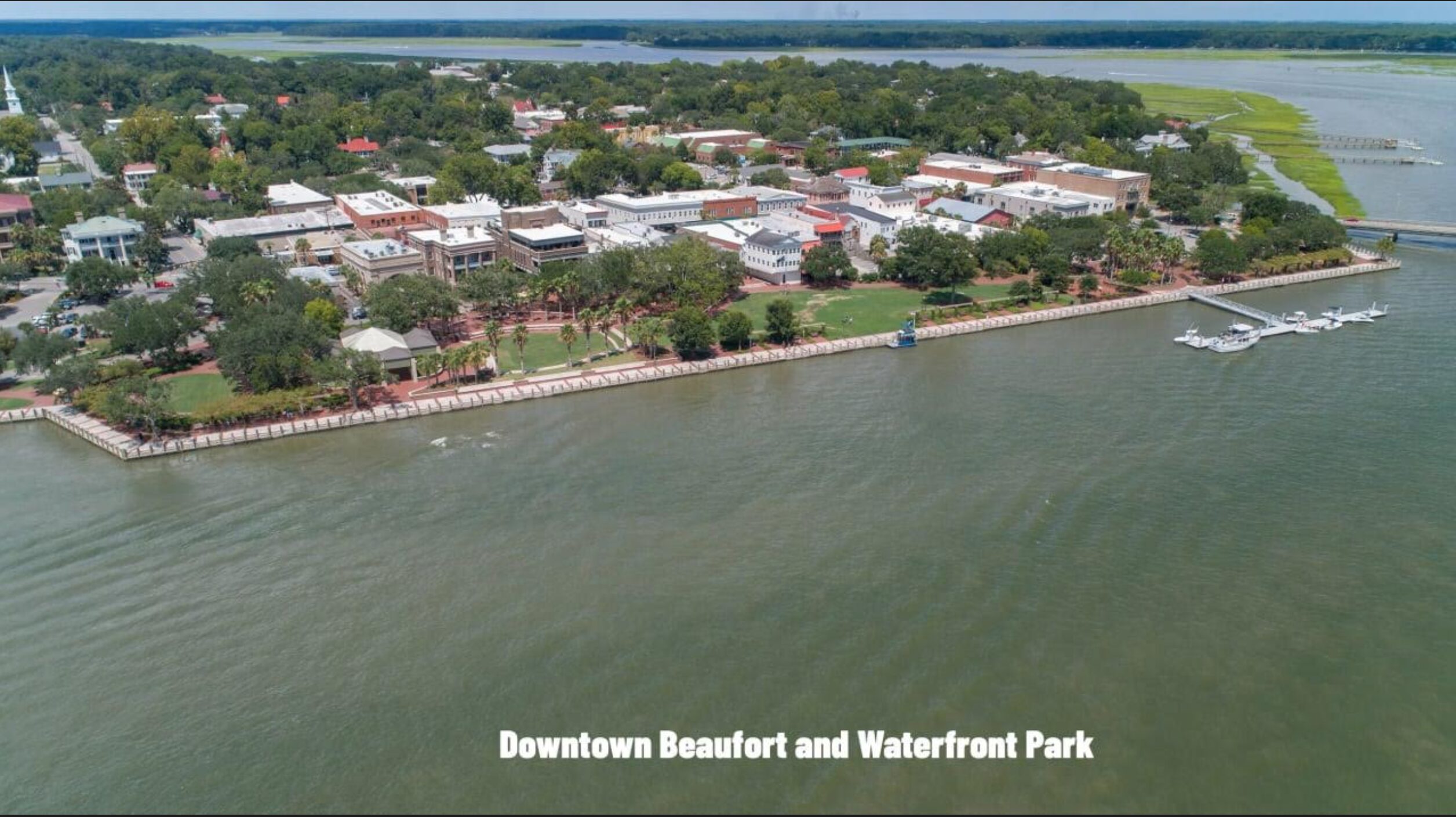

During the February 2024 City Council planning retreat, council requested that city officials complete a Return on Investment Analysis for properties owned by the City of Beaufort. At the November 19 Special Work Session, City Manager Scott Marshall and City Finance Director Alan Eisenman reported back to the council. In the work session, Mayor Cromer explained the purpose of the presentation was to look at properties owned by the city to see if they are still appropriate for the city to own and operate. Cromer stated there could be a possibility to sell city properties if the council deemed them more beneficial on the tax rolls than under the city’s operation and maintenance.

The presentation included six categories of properties: Staff Occupied/Operational Use, Passive Parks, Improved Properties, Unimproved Properties, Beaufort Commerce Park, and a Cell Phone Tower. Marshall and Eisenman started the presentation by presenting the formula they had devised to determine an “ROI percentage” for each property. Before the presentation even got into the property by property analysis, the methods city staff used were confusing. It seemed odd to factor in the purchase price of properties that were purchased well over 100 years ago and then put that up against revenues and expenses from the property for only the last five years, but that was the report they had prepared. By their calculations, even properties that had $0 in revenue and huge numbers in expenses were coming back with positive “ROI percentages”. For example, a staff occupied building at 16 Burton Hill Road (p.196) had $0 revenue and $577,453 in expenses got an ROI percentage of 92.7%. Another property that caused confusion was 500 Carteret St. The property received a 216% “ROI percentage” even though the expenses were $125,000 more than revenue, and the extensive renovation of the building that happened after the property was purchased was not included in the calculation.

On multiple occasions during the presentation, City Manager Scott Marshall expressed his opinion about the exercise of creating the ROI. When Councilman Lipsitz asked a question about how much revenue a property would bring in taxes if it was privately owned, Marshall answered with, “that’s not what was requested in this report… that would be a different kind of report”. Marshall responded to Councilman Scallate saying that he did not think the city would be looking to sell a fire station by sarcastically saying, “I’ve rejected every offer so far.” Marshall also called including Passive Parks in the presentation absurd.

In the end, the ROI presentation did not accomplish the goals that Mayor Cromer outlined before it began, and left the audience confused. The possibility of selling properties to raise funds and property tax incomes was not discussed. Instead of making an argument for retaining or selling city owned properties, city officials ended up making an argument for the city to be a taxpayer funded real estate investment fund.